Social Security Max 2024 Withholding Table

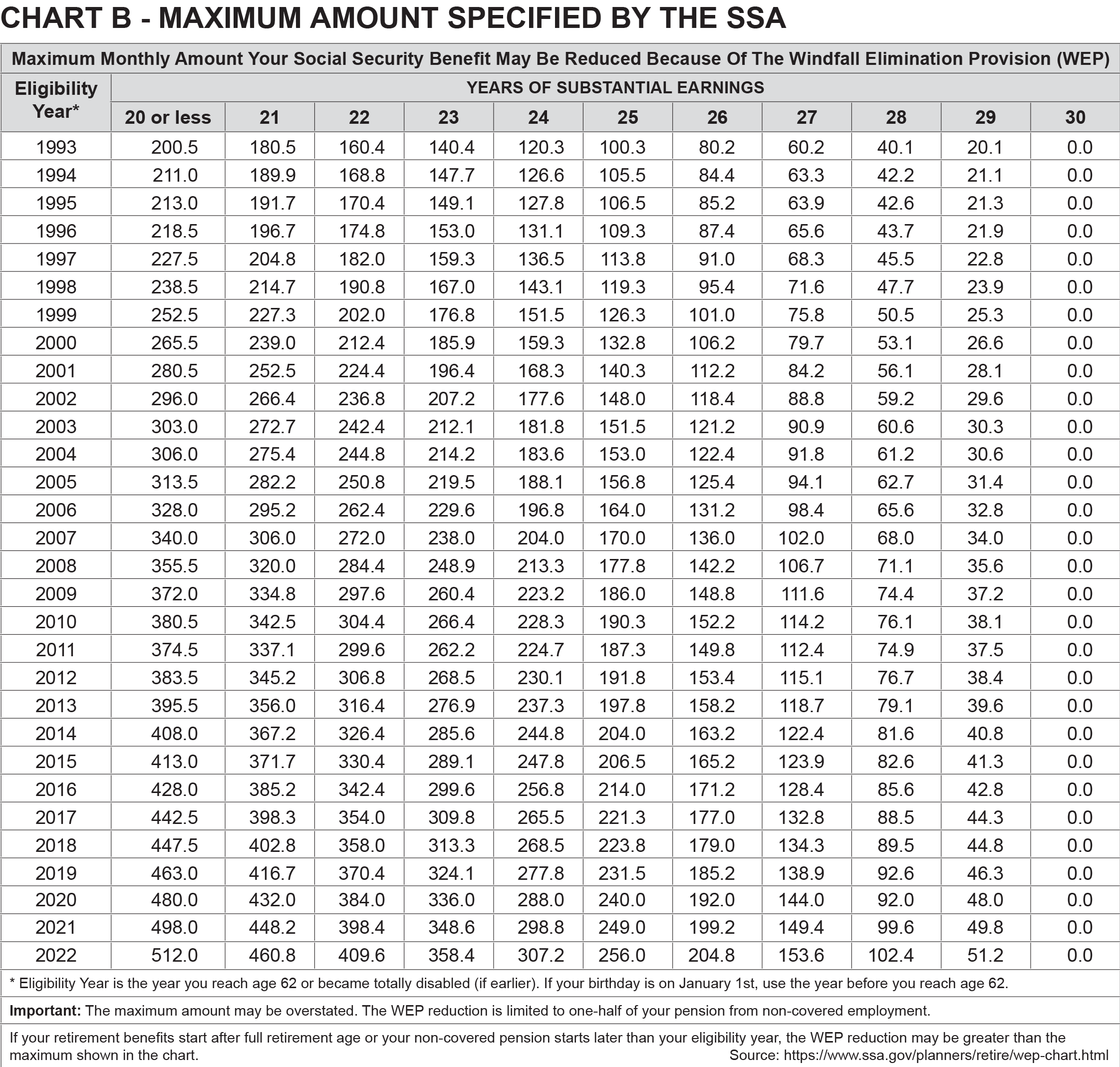

Social Security Max 2024 Withholding Table. The maximum social security benefit you can receive in 2024 ranges from $2,710 to $4,873 per month,. The wage base limit is the maximum wage that's subject to the tax for that year.

We call this annual limit the contribution and benefit base. To determine whether you are subject to irmaa charges, medicare uses the.

Social Security Max 2024 Withholding Table Images References :

Source: kaciebgwyneth.pages.dev

Source: kaciebgwyneth.pages.dev

Social Security Max 2024 Withholding Table Caren Bernice, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2024 (an.

Source: gretelanjanette.pages.dev

Source: gretelanjanette.pages.dev

Maximum Social Security Tax 2024 Withholding Amount Kippy Merrill, The law requires employers to withhold a certain percentage of an employee’s wages to help fund social security and medicare.

Source: ebbaylouisa.pages.dev

Source: ebbaylouisa.pages.dev

Social Security Withholding 2024 Maximum Age Katha Maurene, The 2024 limit is $168,600, up from $160,200 in 2023.

Source: mornaqnorrie.pages.dev

Source: mornaqnorrie.pages.dev

Social Security Withholding 2024 Binny Cheslie, Here are the 2024 irs limits.

Source: andibroxanne.pages.dev

Source: andibroxanne.pages.dev

2024 Social Security Withholding Rates Nydia Arabella, That means that the maximum amount of social security tax an employee will pay.

Source: kaciebgwyneth.pages.dev

Source: kaciebgwyneth.pages.dev

Social Security Max 2024 Withholding Table Caren Bernice, For earnings in 2024, this base is $168,600.

Source: sondrawenid.pages.dev

Source: sondrawenid.pages.dev

2024 Social Security Maximum Withholding Edyth Haleigh, Listed below are the maximum taxable earnings for social security by year from 1937 to the present.

Source: ebbaylouisa.pages.dev

Source: ebbaylouisa.pages.dev

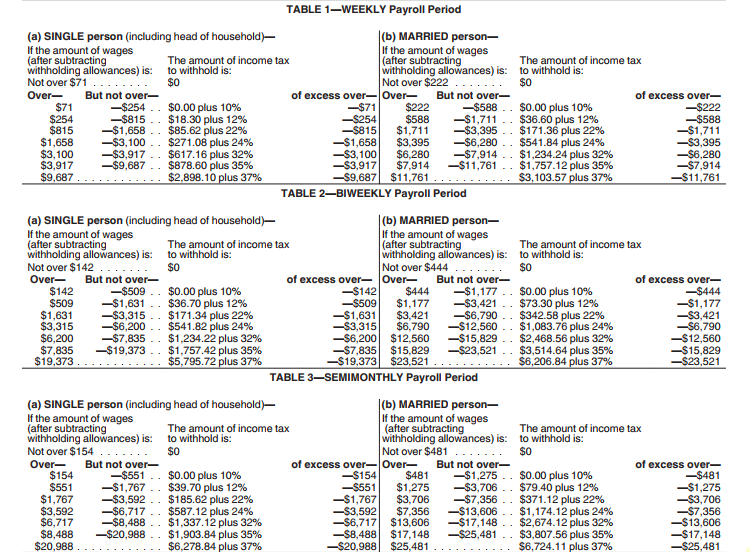

Maximum Social Security Withholding 2024 Married Jointly Katha Maurene, Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system.

Source: kaciebgwyneth.pages.dev

Source: kaciebgwyneth.pages.dev

Social Security Max 2024 Withholding Table Caren Bernice, You file a federal tax return as an individual and your combined income is between $25,000 and $34,000.

Source: debbiebleonelle.pages.dev

Source: debbiebleonelle.pages.dev

Maximum Social Security Withholding 2024 Bonny Christy, The law requires employers to withhold a certain percentage of an employee’s wages to help fund social security and medicare.