Nebraska Homestead Exemption 2024 Calculator

Nebraska Homestead Exemption 2024 Calculator. Accept and process personal property schedules. The nebraska homestead exemption program is a property tax relief program for seven categories of homeowners:

The state of nebraska reimburses the counties. The nebraska homestead exemption program is a property tax relief program that reduces all or a portion of taxes for homeowners in nebraska who occupy a home, used as their.

Lb126, Introduced By Omaha Sen.

Over 65 applicant qualifies for 100% based on the income criteria.

Verify And Maintain A Sales File For All Property Sales Within The.

Homestead exemptions provide relief from property taxes by exempting all or a portion of the valuation of the homestead from taxation.

Nebraska Homestead Exemption 2024 Calculator Images References :

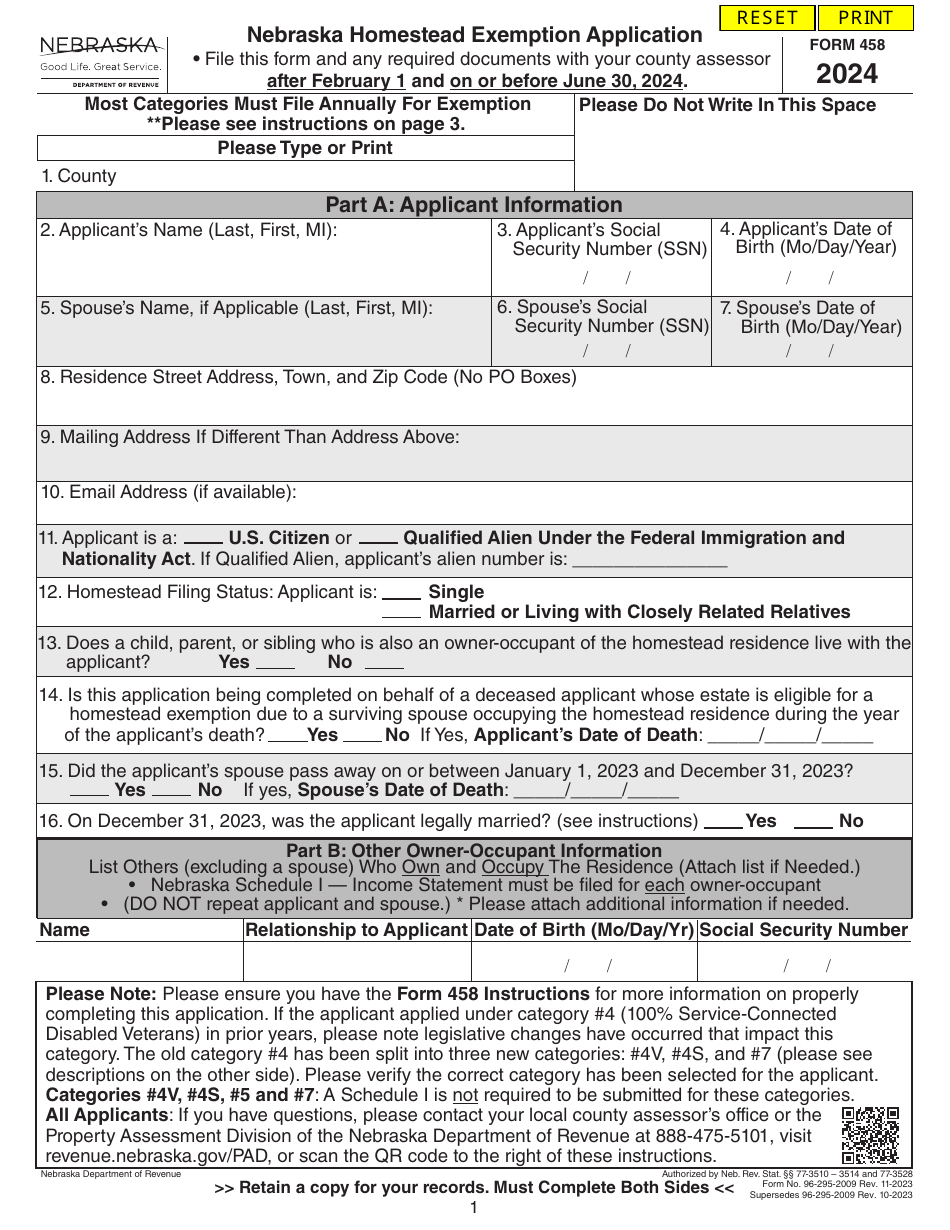

Source: www.templateroller.com

Source: www.templateroller.com

Form 458 Download Fillable PDF or Fill Online Nebraska Homestead, Day mo1342 recommit to the revenue committee filed. You must file between february 1st and june 30th every year in the assessor's.

Source: www.pdffiller.com

Source: www.pdffiller.com

Fillable Online Nebraska Homestead Exemption Application, The nebraska governor april 23 signed a law modifying homestead exemption qualifications. You must live in the home to qualify for the tax break.

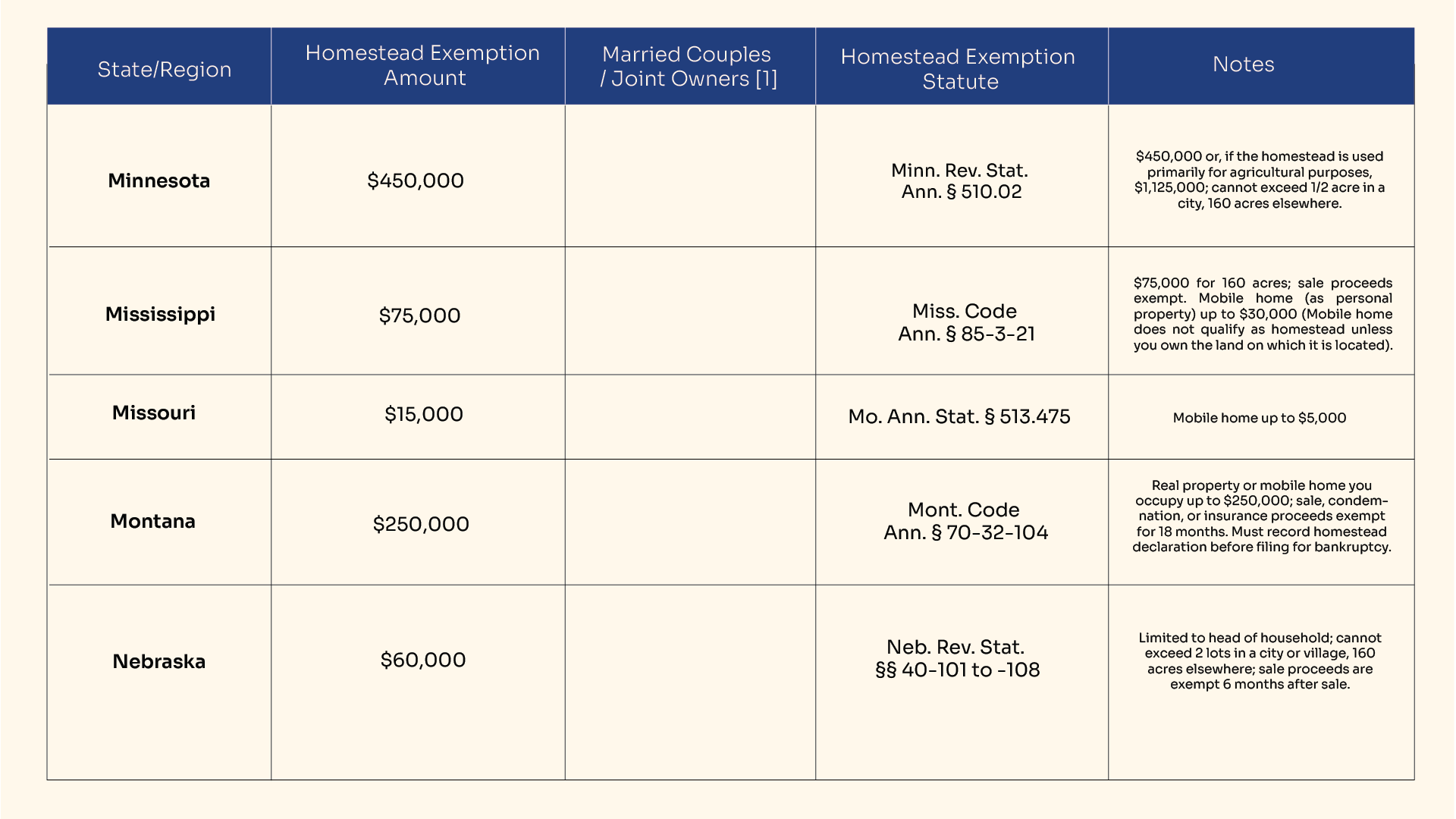

Source: bezit.co

Source: bezit.co

Homestead Exemptions by State in USA in 2024 Bezit.co, The state of nebraska offers a property tax relief program known as the homestead exemption. The nebraska homestead exemption for seniors is a property tax relief program that reduces a portion of taxes for homeowners in nebraska who occupy a home, used as.

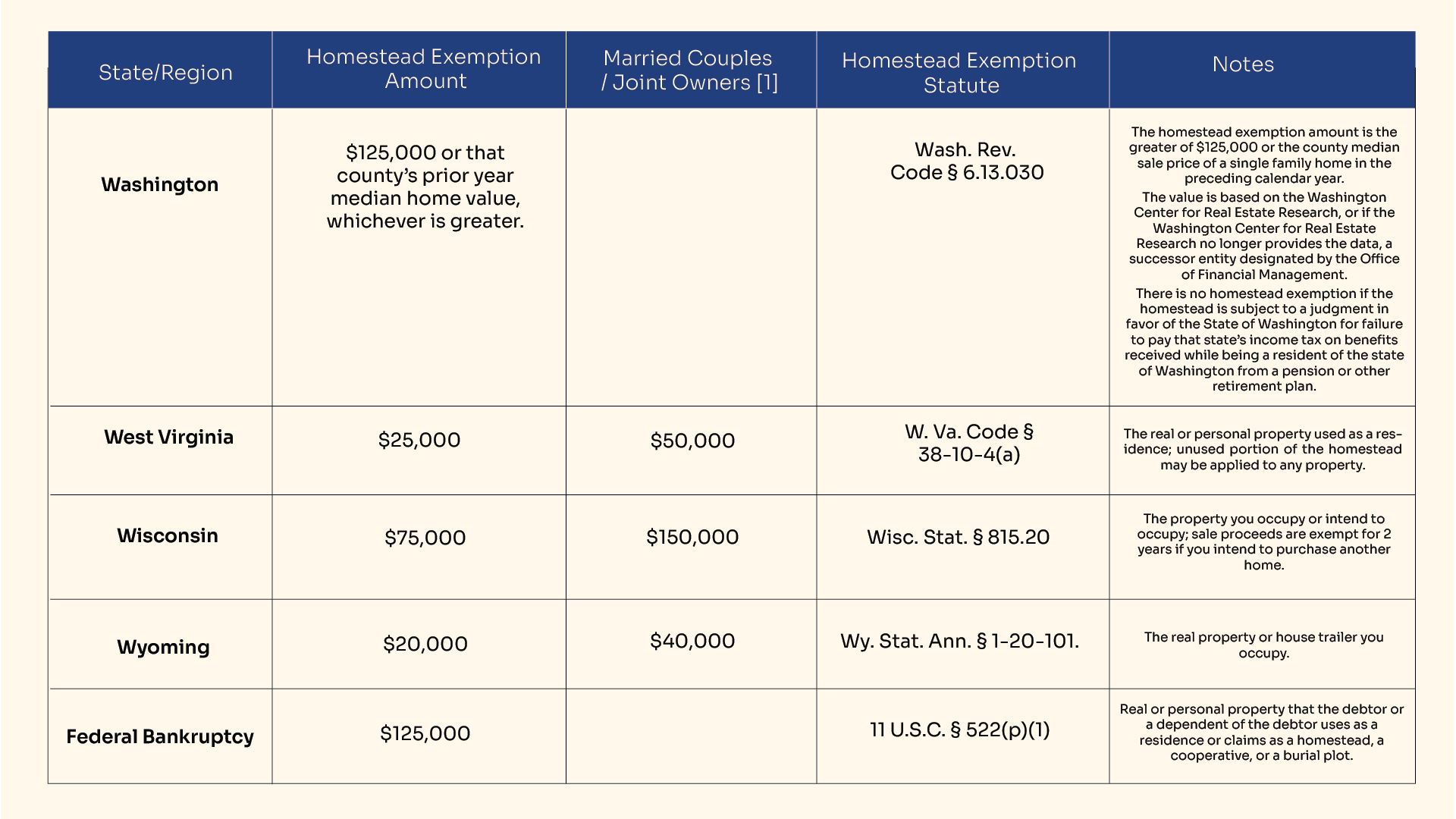

Source: bezit.co

Source: bezit.co

Homestead Exemptions by State in USA in 2024 Bezit.co, Smartasset's nebraska paycheck calculator shows your hourly and salary income after federal, state and local taxes. Nebraska department of revenue homestead exemption guide.

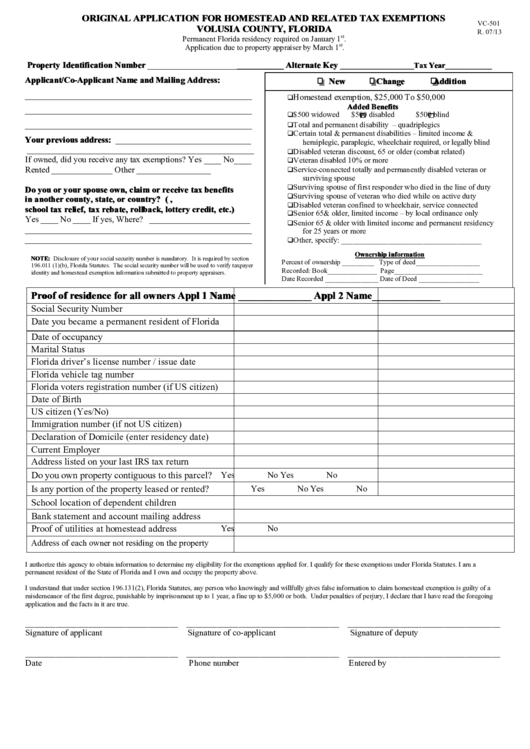

Source: www.pdffiller.com

Source: www.pdffiller.com

Fillable Online Nebraska Homestead Exemption Application Application, Applicants must file form 458 ,. Over 65 applicant qualifies for 100% based on the income criteria.

Source: ainsleewpammy.pages.dev

Source: ainsleewpammy.pages.dev

2024 Application For Residential Homestead Exemption Klara Michell, You may file for a homestead exemption if. Over 65 applicant qualifies for 100% based on the income criteria.

Source: gayleenwzarla.pages.dev

Source: gayleenwzarla.pages.dev

Texas Homestead Exemption Changes 2024 Eddy Liliane, Lawmakers gave final approval april 18 to a bill modifying nebraska’s homestead exemption program. For certain individuals, the homestead exemption program provides relief from property taxes by exempting all or a portion of the valuation of a home from taxation, with the.

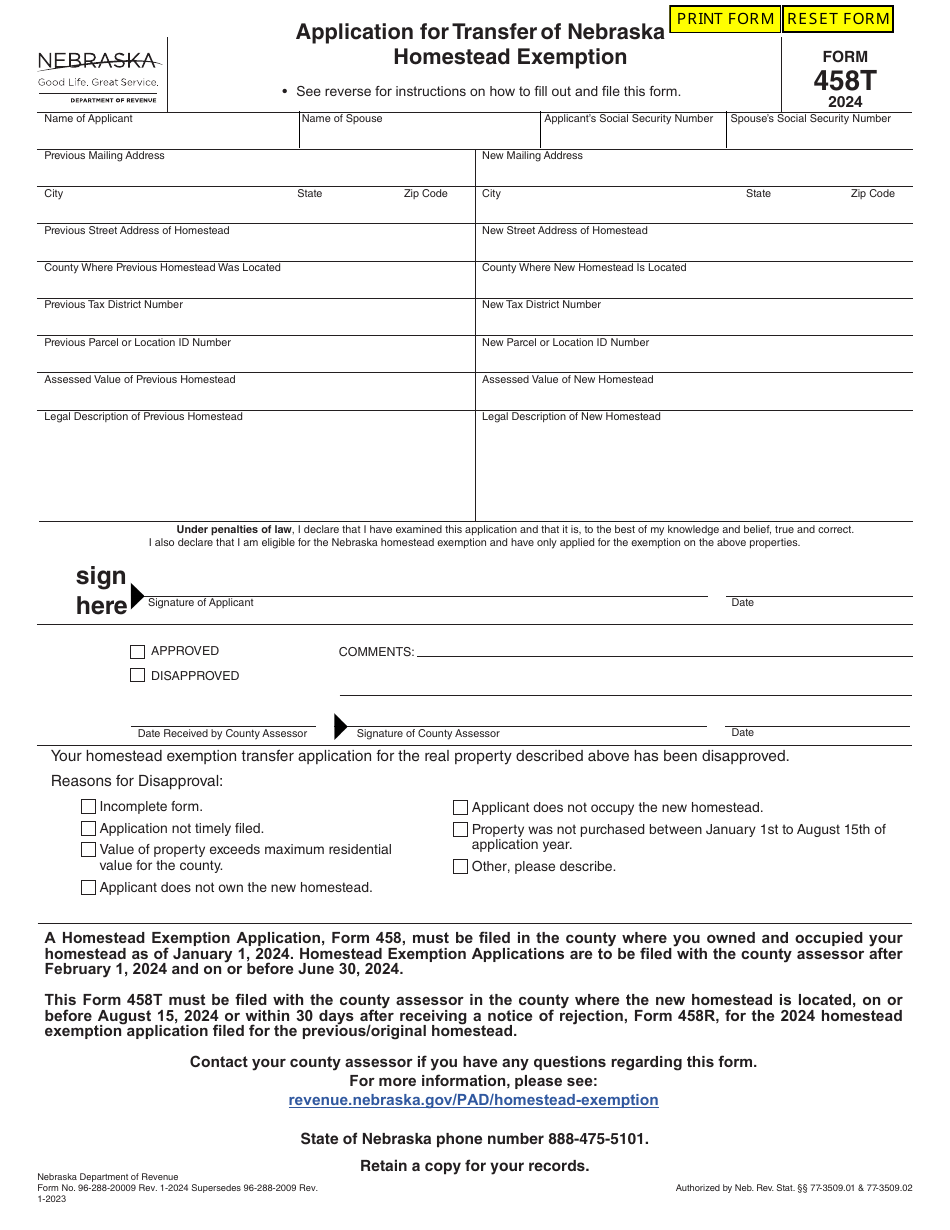

Source: www.templateroller.com

Source: www.templateroller.com

Form 458T Download Fillable PDF or Fill Online Application for Transfer, For certain individuals, the homestead exemption program provides relief from property taxes by exempting all or a portion of the valuation of a home from taxation, with the. Nebraska department of revenue homestead exemption guide.

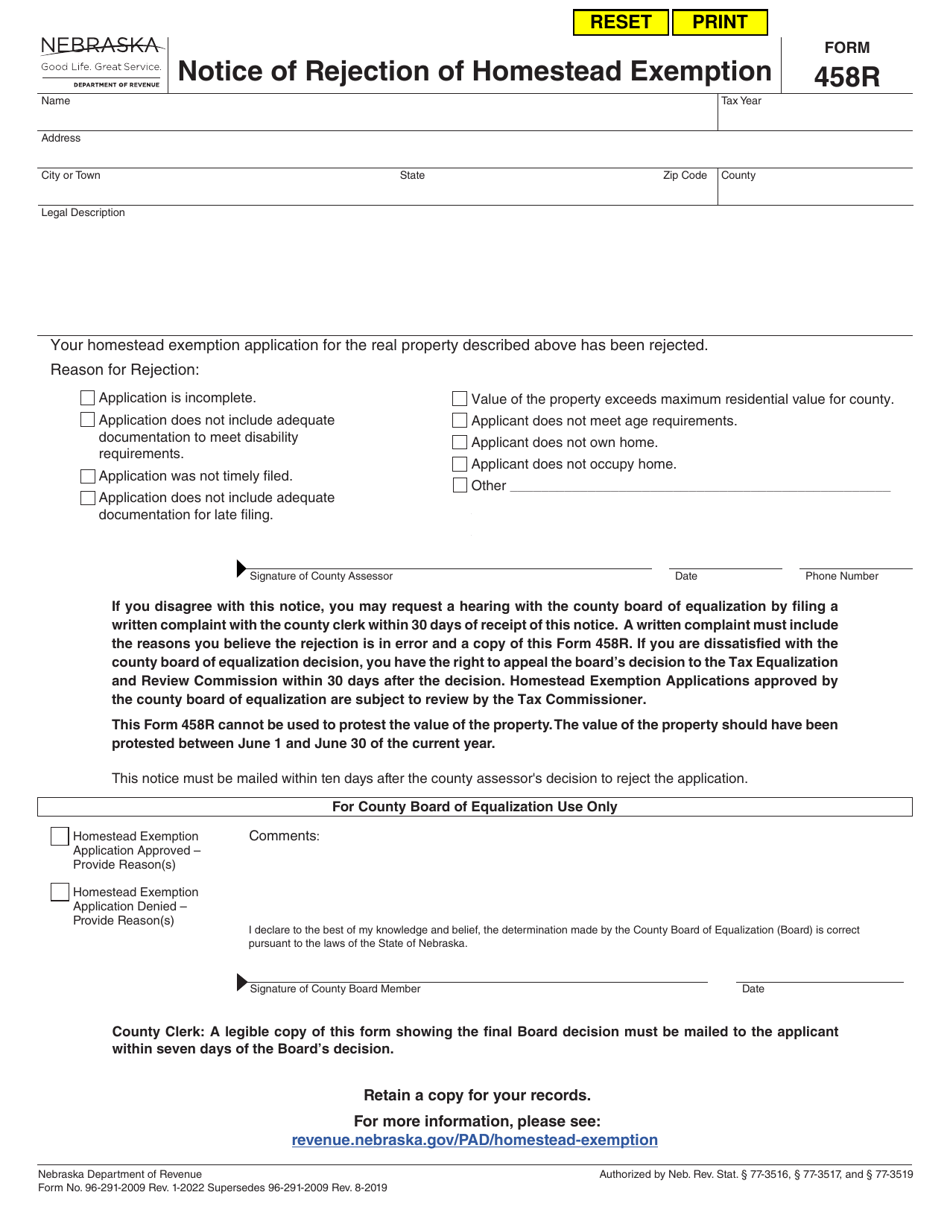

Source: www.templateroller.com

Source: www.templateroller.com

Form 458R Fill Out, Sign Online and Download Fillable PDF, Nebraska, Verify and maintain a sales file for all property sales within the. The nebraska department of revenue, property assessment division (department) reminds property owners that the nebraska.

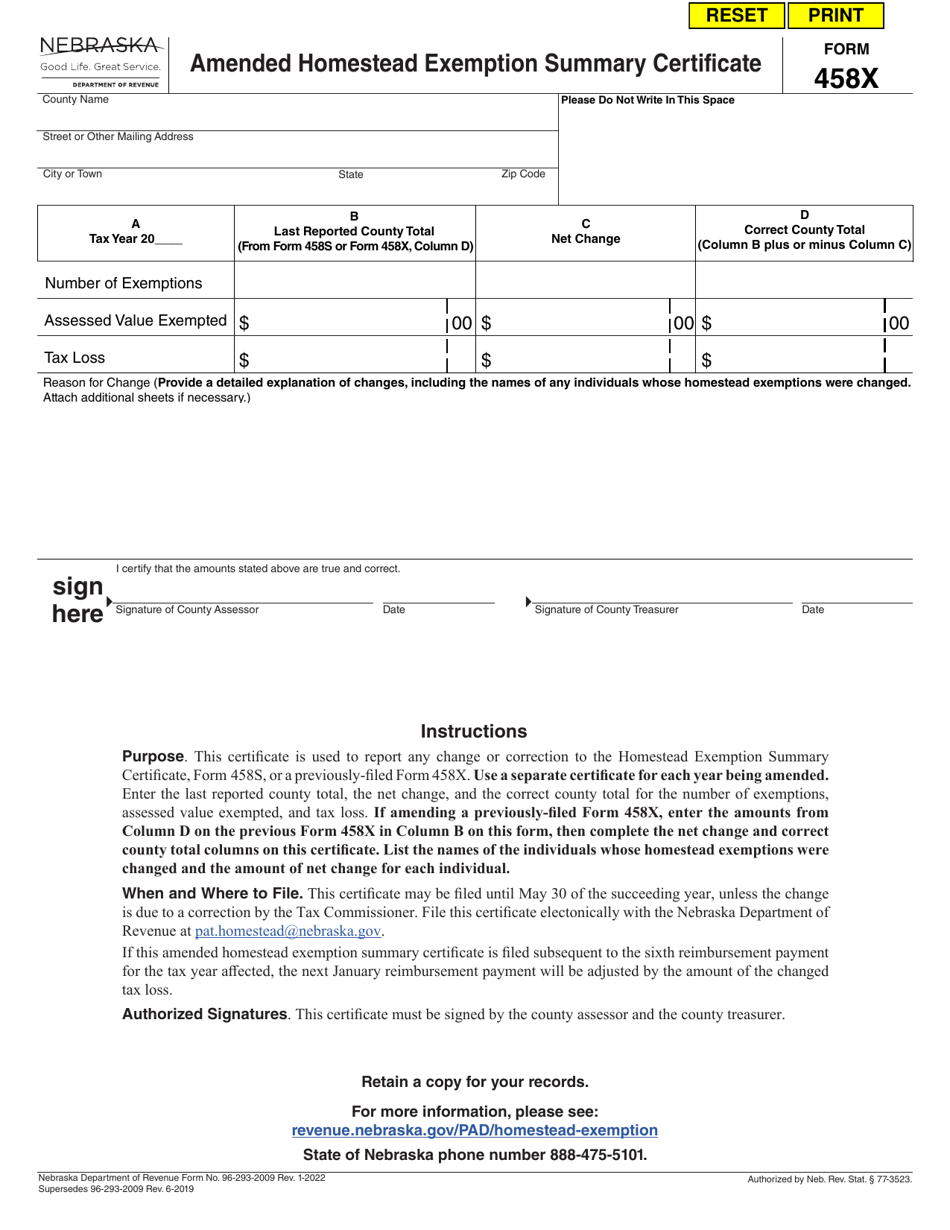

Source: www.templateroller.com

Source: www.templateroller.com

Form 458X Download Fillable PDF or Fill Online Amended Homestead, Day mo1342 recommit to the revenue committee filed. If you have not yet filed your 2024 nebraska homestead exemption application, you may still be eligible to apply for a property tax exemption.

Tax Year 2024 Homestead Exemption.

The nebraska homestead exemption for seniors is a property tax relief program that reduces a portion of taxes for homeowners in nebraska who occupy a home, used as.

The State Of Nebraska Reimburses The Counties.

Smartasset’s nebraska paycheck calculator shows your hourly and salary income after federal, state and local taxes.